/shutterstock_150346775-5c5775c946e0fb0001be6f3d.jpg) Value-added tax (VAT) is a consumption tax levied on goods and services at every stage of the supply chain where value is added, from production to the point of sale. Unlike a sales tax, which is...

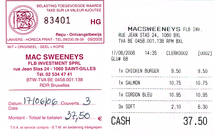

Value-added tax (VAT) is a consumption tax levied on goods and services at every stage of the supply chain where value is added, from production to the point of sale. Unlike a sales tax, which is... A value-added tax (VAT or goods and services tax (GST), general consumption tax (GCT)) is a consumption tax that is levied on the value added at each stage of a product's production and distribution. VAT is similar to, and is often compared with, a sales tax.

A value-added tax (VAT or goods and services tax (GST), general consumption tax (GCT)) is a consumption tax that is levied on the value added at each stage of a product's production and distribution. VAT is similar to, and is often compared with, a sales tax./making-a-sale-at-cafe-524400106-3bd9cd71475a4d17a27ac1a773ad2e4c.jpg) A value-added tax (VAT) is a consumption tax levied at every stage of production for a good or service. This includes the raw materials producer, the factory, the wholesaler, and the retailer—all...

A value-added tax (VAT) is a consumption tax levied at every stage of production for a good or service. This includes the raw materials producer, the factory, the wholesaler, and the retailer—all...